GREEN PERFORMANCE AND INTEGRATED REPORTING: DOES INSTITUTIONAL OWNERSHIP AMPLIFY ITS IMPACT ON COMPANY VALUE?

DOI:

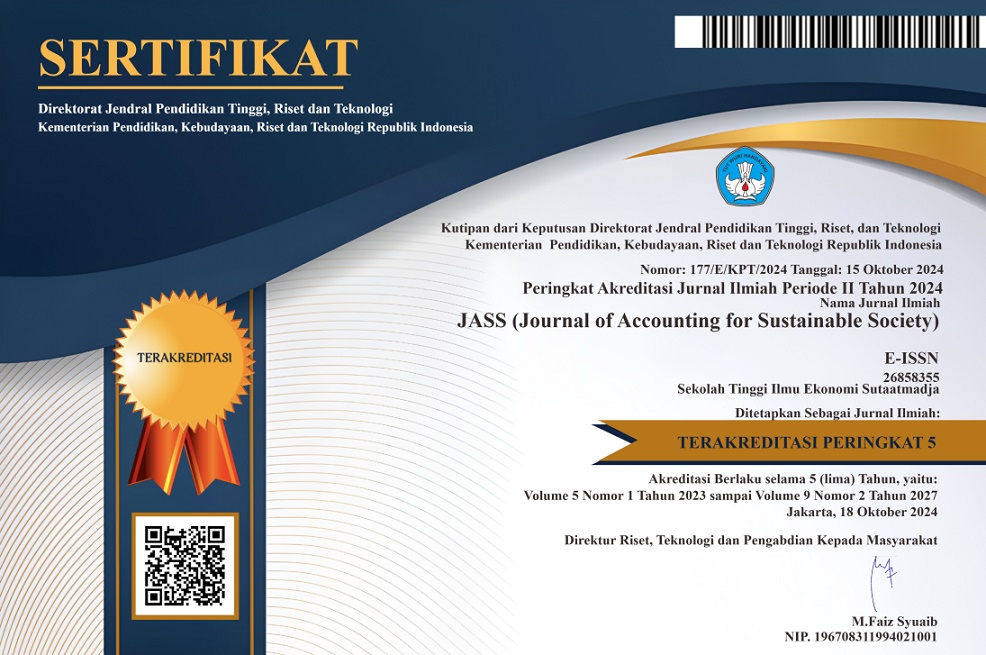

https://doi.org/10.35310/jass.v7i02.1633Abstract

This study aims to examine the effect of Integrated Reporting and Environmental Performance on Firm Value, with Institutional Ownership as a moderating variable. The research focuses on industrial sub-sector companies listed on the Indonesia Stock Exchange (IDX) during the 2022-2024 period. The sample used was 36 observations using a purposive sampling method. The data analysis methods used are classical assumption tests, multiple linear regression analysis, and Moderated Regression Analysis (MRA). The research results show that Integrated Reporting has no significant effect on Firm Value. In contrast, Environmental Performance is proven to have a positive and significant effect on Firm Value. Furthermore, the moderation test results show that Institutional Ownership is not able to moderate the relationship between Integrated Reporting and Firm Value. However, Institutional Ownership is proven to positively and significantly moderate the relationship between Environmental Performance and Firm Value. These findings indicate that institutional investors play an important role in increasing market appreciation for corporate environmental performance.

Program Studi Akuntansi

Program Studi Akuntansi