The Effect Of Tax Accounting Choice, Size And Multinational Company On Tax Aggresiveness

The Effect Of Tax Accounting Choice, Size And Multinational Company On Tax Aggresiveness

DOI:

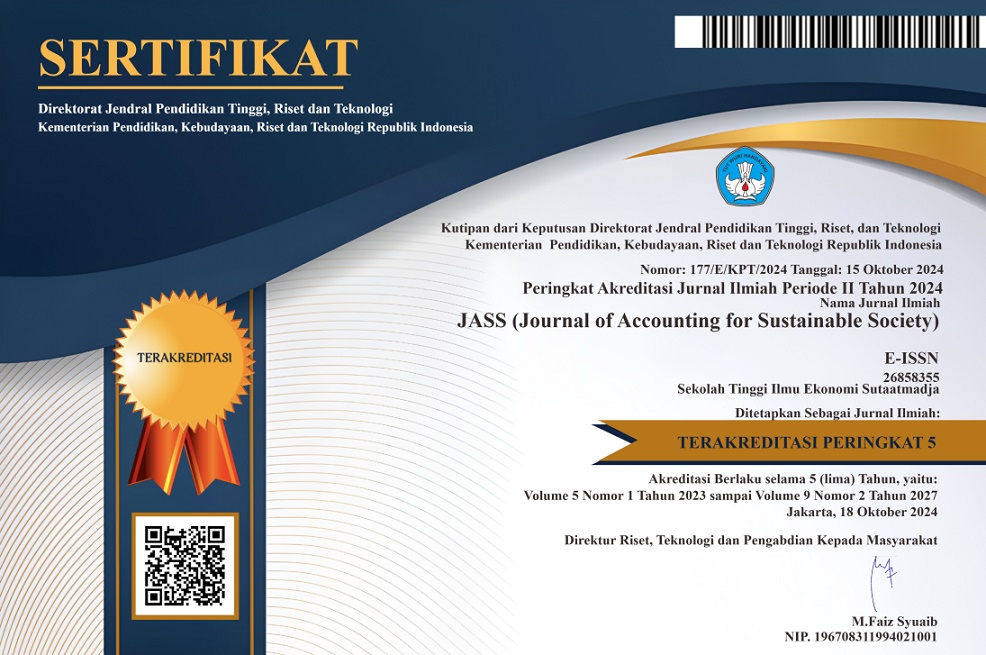

https://doi.org/10.35310/jass.v5i02.1168Keywords:

Tax Accounting Choices, Size, Multinational Company, Tax AggresivenessAbstract

This study aims to analyze the variables of Tax Accounting Choices, Size and Multinational Company on Tax Aggressiveness. The sample used in this study was 28 Basic Industrial and Chemical Sector Manufacturing companies listed on the Indonesia Stock Exchange (IDX) during the period 2020 - 2022. Samples are taken by purposive random sampling using certain criteria.

Tax Accounting Choices are measured by the dummy variable of choosing the depreciation method of fixed assets, while for Size is measured by the value of the Natural Logarithm (LN) of total assets. Multinational Company is measured using dummy variables where companies operating at the international level are given a score of 1 and 0 if the company is not operating international class.

The results of this study show that Tax Accounting Choice and Multinational Company have no effect on Tax Aggresiveness. While the Size variable has a negative effect on Tax Aggresiveness.

References

Amalia, D. (2021). Pengaruh Likuiditas, Leverage dan Intensitas Aset Terhadap Agresivitas Pajak. Jurnal Kumpulan Riset Akuntansi, 12(2), 232–240.

Gunawan, F., & Nuswandari, C. (2019). Likuiditas, Leverage, Fixed Assets Intensity, Arus Kas Operasi, Dan Ukuran Perusahaan Terhadap Pemilihan Model Revaluasi Aset Tetap. Journal of Chemical Information and Modeling, 53(9), 1689–1699.

Harnovinsah, & Septyana. (2016). Harnovinsah dan Muarakah: Dampak Tax Accounting Choices Terhadap Tax Aggressive DAMPAK TAX ACCOUNTING CHOICES TERHADAP TAX AGGRESSIVE. XX(02), 267–284.

Hendra, J., Winanto, A., Rahmansyah, A. I., Rinaldi, M., & Monica, O. (2023). Buku Ajar Akuntansi Pajak. www.buku.sonpedia.com

Hutauruk, M. R., Mansyur, M., Rinaldi, M., & Situru, Y. R. (2021). Financial Distress Pada Perusahaan Yang Terdaftar Di Bursa Efek Indonesia. JPS (Jurnal Perbankan Syariah), 2(2), 237–246. https://doi.org/10.46367/jps.v2i2.381

Irwansyah, Rinaldi, M., Yusuf, A. M., Ramadhani, M. H. Z. K., Sudirman, S. R., & Yudaruddin, R. (2023). The Effect of COVID-19 on Consumer Goods Sector Performance: The Role of Firm Characteristics. Journal of Risk and Financial Management, 16(11), 483. https://doi.org/10.3390/jrfm16110483

Leksono, A. W., Albertus, S. S., & Vhalery, R. (2019). Pengaruh Ukuran Perusahaan dan Profitabilitas terhadap Agresivitas Pajak pada Perusahaan Manufaktur yang Listing di BEI Periode Tahun 2013–2017. JABE (Journal of Applied Business and Economic), 5(4), 301. https://doi.org/10.30998/jabe.v5i4.4174

Luddiana, F., Purnomo, H., & Juliasari, D. (2020). Pengaruh Return On Asset (ROA), Return On Equity (ROE) Dan Net Profit Margin (NPM) Terhadap Harga Saham Pada Perusahaan Manufaktur Yang Terdaftar Di Bursa Efek Indonesia Tahun 2010-2013. 3(2), 54–67.

Nurrahma Dewi, & Hariadi, A. N. dan. (2016). (Studi Empiris Perusahaan Pertambangan yang Terdaftar di BEI 2011-2013) Oleh : Nurrahma Dewi Pembimbing: Azwir Nasir dan Hariadi. JOM Fekon Vol.3 No.1 Februari, 1006–1020.

Oktafiani, F., Hasibuan, R. P. A., Safira, R. D., Rinaldi, M., & Ginting, J. V. B. (2023). Effect Of Profitability, Leverage, And Company Size On Tax Avoidance In Plantation Sector Companies. Journal of Innovation Research and Knowledge (JIRK), 2(9), 2023. www.idx.co.id.

Puspita, E. R., Nurlaela, S., & Masitoh, E. (2018). Pengaruh Size, DEBTS, Intangible Assets, Profitability, Multinationality dan Sales Growth Terhadap Tax Avoidance. Manajemen, Akuntansi Dan Perbankkan, 794–807.

Ramadhani, M. A., Rinaldi, M., Sudirman, S. R., & Ramadhani, M. H. Z. K. (2023). Analyzing the Effect of Current Ratio and Debt to Equity Ratio on Stock Returns in the Automotive and Component Subsector Companies Listed on the Indonesia Stock Exchange. EKALAYA : Jurnal Ekonomi Akuntansi, 1(2), 58–66. https://doi.org/10.59966/ekalaya.v1i2.148

Ramadhani, M. H. Z. K., Rinaldi, M., Yusuf, A. M., Sudirman, S. R., & Ramadhani, M. A. (2023). Potential Sectors That Can Help Increase Local Revenue in Mahakam Ulu. The Es Accounting and Finance, 1(03), 150–159. https://doi.org/10.58812/esaf.v1.i03

Ramadhani, M. H. Z. K., Ulfah, Y., & Rinaldi, M. (2022). The Impact of Bitcoin Halving Day on Stock Market in Indonesia. Journal of International Conference Proceedings, 5(3), 127–137. https://doi.org/10.32535/jicp.v5i3.1800

Rinaldi, M., Ramadhani, M. A., Sudirman, S. R., & Ramadhani, M. H. Z. K. (2023a). Financial Performance’s Impact on Tax Avoidance. The ES Economy and Entrepreneurship, 01(03), 125–131.

Rinaldi, M., Ramadhani, M. H. Z. K., Sudirman, S. R., & Ramadhani, M. A. (2023b). Pengaruh Leverage, Intensitas Modal Dan Kompensasi Rugi Fiskal Terhadap Penghindaran Pajak. Jurnal Ekonomi Akuntansi Dan Manajemen, 3(1). https://journal.uniku.ac.id/index.php/jeam

Rinaldi, M., Respati, N. W., & Fatimah. (2020). Pengaruh Corporate Social Responsibility, Political Connection, Capital Intensity Dan Inventory Intensity Terhadap Tax Aggressiveness. SIMAK, 18(02), 149–171.

Sandag, E. C., Neltje, C., Rotinsulu, M., Tandiawan, V., & Rinaldi, M. (2022). Profitability and Company Size Have a Strong Influence on Tax Avoidance. Al Khanaj Journal of Islamic Economic and Business, 4(2), 103–114. https://doi.org/10.24256

Savitri, D. A. M., & Rahmawati, I. N. (2017). p-ISSN 2086-3748. 8(November), 64–79.

Soerzawa, D., Yusmaniarti, & Suhendra, C. (2018). Pengaruh Penghindaran Pajak terhadap Nilai Perusahaan dengan Leverage sebagai Variabel Moderasi. BILANCIA: Jurnal Ilmiah Akuntansi, 2(4), 367–377.

Sudirman, S. R., Rinaldi, M., & Ramadhani, M. H. Z. K. (2023). Analysis of Tax Collection with Reprimand and Forced Letters at the North Makassar. The ES Economy and Entrepreneurship, 01(03), 131–137.

Susilowati, Y., Ratih Widyawati, & Nuraini. (2018). Pengaruh Ukuran Perusahaan, Leverage, Profitabilitas, Capital Intensity Ratio dan Komisaris Independen Terhadap Effective Tax Rate. Isbn: 978-979-3649-99-3, 2014, 796–804.

Wardani, D. K., & Khoiriyah, D. (2018). Pengaruh Strategi Bisnis dan Karakteristik Perusahaan Terhadap Penghindaran Pajak. Akuntansi Dewantara, 2(1), 25–36.

Astuti, R., & Sugiharto, B. (2019). Pengaruh Locus of Control, Ethical Sensitivity, Kecerdasan Intelektual, Kecerdasan Emosional, Kecerdasan Spiritual dan Tingkat Pendidikan Terhadap Perilaku Etis. Jurnal ASET (Akuntansi Riset), 11(2), 256-270.

Umiyati, I. (2017). Financial Reporting Quality, Information Asymmetry and Investment Efficiency. Jurnal Akuntansi dan Bisnis, 17(1), 39-53.

Purnamasari, P., & Umiyati, I. (2019). Asymmetric Cost Behavior and Choice of Strategy. Jurnal Reviu Akuntansi dan Keuangan, 9(1), 24-33.

Program Studi Akuntansi

Program Studi Akuntansi