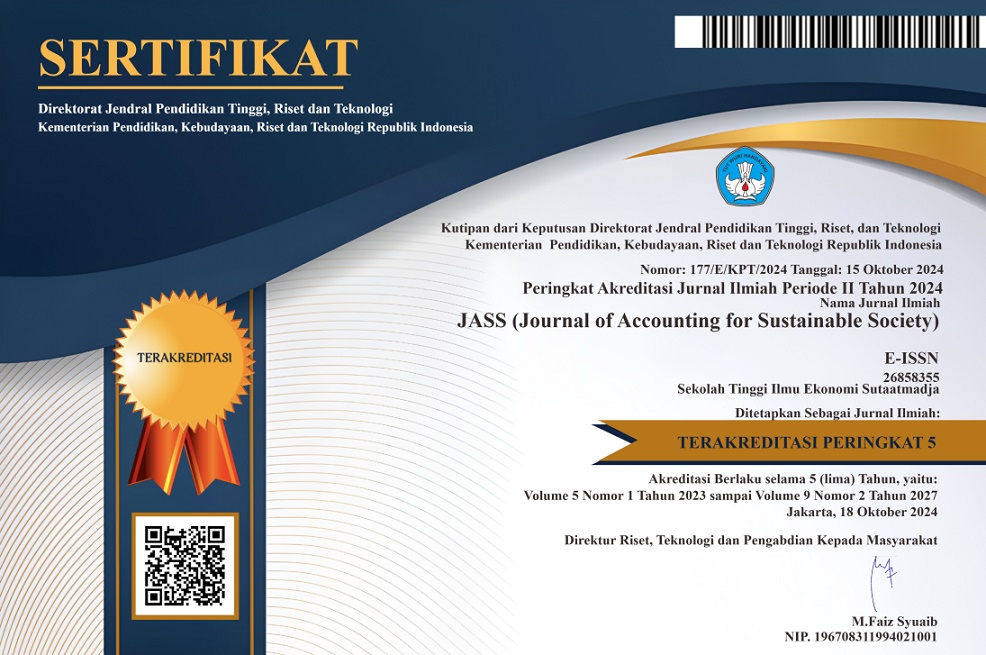

Green Accounting and Sales Growth: A Strategy Toward Sustainable Financial Performance in Energy Companies in Indonesia

Array

DOI:

https://doi.org/10.35310/jass.v7i01.1442Keywords:

Green Accounting, Sales Growth, Financial Performance, ROA, Energy CompaniesAbstract

This study aims to analyze the effect of green accounting and sales growth on the financial performance of energy sector companies listed on the Indonesia Stock Exchange (IDX) during the 2019–2023 period. Financial performance is proxied by Return on Assets (ROA), while green accounting is measured using an environmental CSR cost index relative to net income after tax. Sales growth is calculated based on the percentage change in annual sales. This research employs a quantitative approach using secondary data, and the analytical technique applied is multiple linear regression through SPSS software version 23. The results show that green accounting has a negative effect on financial performance, whereas sales growth has a positive effect. Simultaneously, both variables significantly influence financial performance. These findings imply that although environmental initiatives are important for social legitimacy, their implementation needs to be more efficient and value-oriented. Meanwhile, sales growth proves to be a key factor in driving the profitability of energy companies in Indonesia

References

Anjani, D. R., & Fitrani, E. (2022). Green accounting and its effect on firm performance in the energy sector: Evidence from Indonesia. Jurnal Ilmu dan Riset Akuntansi, 11(2), 123–134.

Dewi, M. K., & Kartika, A. (2021). Green accounting disclosure and firm performance: Empirical study on energy companies in Indonesia. Jurnal Akuntansi dan Keuangan Indonesia, 18(1), 67–79. https://doi.org/10.21002/jaki.v18i1.1329

Handayani, N. P., & Rochmah, W. (2024). Signaling theory in sustainable business practices: Empirical evidence from public companies in Indonesia. Journal of Sustainable Finance and Accounting, 5(1), 45–58.

Nurfadillah, R., Yuliana, R., & Prasetyo, B. D. (2021). Environmental accounting practices and financial performance in the Indonesian energy sector. International Journal of Energy Economics and Policy, 11(4), 293–301.

Sari, V. A., & Saputra, R. A. (2023). Company growth and firm value: The moderating role of investment decisions. Jurnal Keuangan dan Perbankan, 27(1), 112–124.

Wulandari, E., & Fauzan, A. (2023). Legitimacy theory and environmental disclosure: Evidence from energy companies listed in IDX. Jurnal Akuntansi dan Bisnis, 23(2), 89–100.

Yuliani, L., & Prasetyo, A. (2022). Green accounting implementation and corporate performance in environmentally sensitive industries. Jurnal Akuntansi Multiparadigma, 13(1), 123–136.

Program Studi Akuntansi

Program Studi Akuntansi